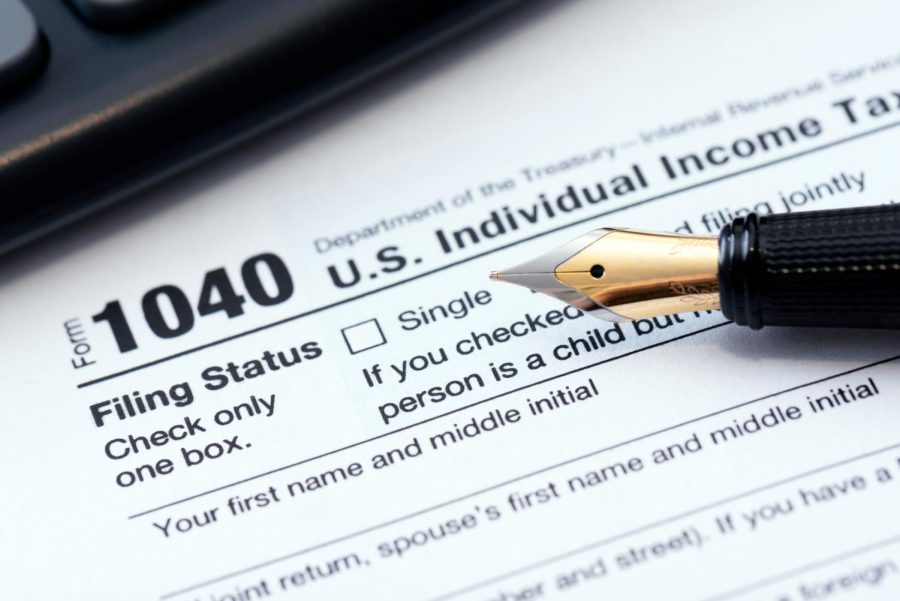

Accounting prof does taxes for free

Students and employees who earned less than $58,000 last year can get their taxes done for free through an IRS-sponsored program on campus.

February 7, 2022

An accounting professor is offering to fill out tax forms for free for students, faculty and staff this spring.

Michael Gavin, along with some students and other faculty, will do federal and state tax forms for anyone on campus or in the community who earned less than $58,000 in 2021 as part of an IRS-sponsored program called Volunteer Income Tax Assistance or VITA.

“Taxes are difficult,” said Gavin, who noted that many of the clients are “single working people … younger people that are just starting their careers.”

VITA is a federal government program that uses IRS-certified volunteers to review clients’ tax situations and prepare returns.

This is the eighth year AACC will participate in the VITA program. Twenty-eight other organizations in Maryland also are doing free taxes.

People who are interested in using the service can make an in-person or virtual appointment to have their taxes prepared within an hour.

“The goal of the IRS is to help the public that can not understand the tax system,” Gavin said.

About 20 students and a few staff members help Gavin with the taxes.

“They give up their Saturday mornings to come in here and do this,” Gavin said. “I’m just so proud [of them].”

The volunteers do not receive pay or college credit for helping out, Gavin said, but they gain real-world experience to help further their education and future careers.

“I always wanted to do taxes since high school,” Ann Joby, a student volunteer and business administration student, said. “I’m really into accounting so ever since professor Gavin gave me the opportunity to join this program, I [have been] thrilled.”

To make an appointment, email VITA@aacc.edu.